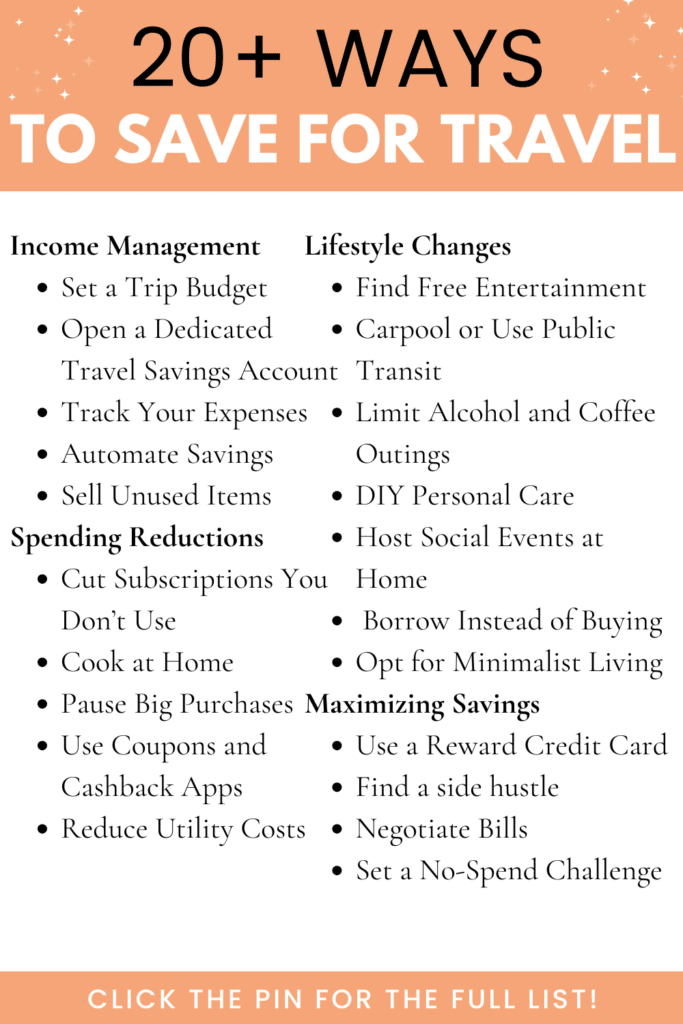

How to Save Money for a Trip

Disclaimer: This post may contain affiliate links, which means that if you click on any of those links and make a purchase, I’ll get a small commission, at no cost to you, to help support this website.

As traveling is one of my favorite things to do, I managed to find so many different ways to spend less in my daily life so I could enjoy traveling more often.

It all comes down to prioritizing what’s more important to you. If traveling is your goal, then you need to be able to sacrifice a little right now. For me, the easiest thing to cut down was eating out and as I have a pretty minimalist mindset, saving instead of spending always came easy for me.

I’ve always preferred to spend money on experiences rather than things. Slowly coming into that mindset will allow you to save for that big trip that you’re planning.

Start with little things, evaluate what expenses you can easily cut out from your life, and slowly build up to bigger things.

With good planning and control over your spending, you should be able to save enough yearly for traveling. Discover below my top tips to save money to travel.

Income Management

1. Set a Trip Budget

- Break it Down: Research and itemize costs for your trip. Include major categories like airfare, accommodation, food, local transportation, activities, souvenirs, and a small buffer for emergencies.

- Example: If your trip budget is $3,000, divide it into monthly or weekly savings goals. For instance, if your trip is 10 months away, aim to save $300 per month.

2. Open a Dedicated Travel Savings Account

- Why It Helps: Keeping travel savings separate reduces the temptation to dip into the funds for everyday expenses.

- Tips for Setup:

- Choose a high-yield savings account (HYSA) to earn interest while you save.

- Name the account something inspirational, like “Hawaii Fund” or “Dream Europe Trip.”

- Use a bank or financial app that lets you automate and track savings progress visually.

3. Track Your Expenses

- Start Small: For one week, write down every dollar you spend. Use apps like Mint, PocketGuard, or a simple notebook. This helps you understand your current spending habits.

- Categorize: Break down expenses into categories like food, transportation, entertainment, and subscriptions.

- Adjust: Identify the categories where you overspend and set caps. For example, reduce weekly dining-out expenses from $60 to $30, and redirect the extra $30 to your travel fund.

4. Automate Savings

- How to Automate:

- Set up a recurring transfer to your travel savings account. For instance, transfer $50 every Friday after payday.

- Round-up savings apps like Acorns can help you save spare change by rounding up purchases to the nearest dollar and depositing the difference into a savings account.

- Psychological Benefits: Automation removes the effort of saving and makes it feel like a natural part of your routine.

5. Sell Unused Items

- Identify Sellable Items:

- Look for clothes you don’t wear, electronics you no longer use, or home items taking up space.

- Example: Sell that old gaming console gathering dust or a designer handbag you rarely carry.

- Platforms to Sell On:

- General: eBay, Craigslist, Facebook Marketplace.

- Clothing: Poshmark, Depop.

- Tech: Gazelle, Decluttr.

- Pro Tips:

- Take high-quality photos and write clear, honest descriptions to attract buyers.

- Set realistic prices based on similar items to ensure quick sales.

Reducing Spendings

6. Cut Subscriptions You Don’t Use

- Audit Your Subscriptions: Check your bank statements or use apps like Truebill or Rocket Money to uncover forgotten or rarely used subscriptions.

- Examples of Commonly Overlooked Subscriptions:

- Streaming services (e.g., Netflix, Hulu, Disney+).

- Gym memberships you rarely use.

- Monthly apps or software you forgot to cancel.

- Switch to Free Alternatives: Replace paid services with free versions when possible, like using Spotify Free instead of Premium.

- Tip: If you’re hesitant to cancel, try pausing subscriptions temporarily and see if you truly miss them.

7. Cook at Home

- Plan Meals: Save money by planning weekly meals and cooking in batches. Use simple, budget-friendly ingredients like rice, pasta, beans, and seasonal vegetables.

- Limit Takeout: Replace dining out with home-cooked versions of your favorite meals. For instance, make homemade pizza or stir-fry instead of ordering in.

- Cost Comparison: If you typically spend $15 on a takeout meal but can make a similar dish at home for $5, that’s a $10 savings per meal. Multiply this by a few meals a week to see significant savings.

- Pro Tip: Take leftovers to work or school instead of buying lunch.

8. Pause Big Purchases

- Wait It Out: Before making non-essential purchases, adopt a “30-day rule.” Write down what you want, and if you still feel it’s necessary after 30 days, reconsider. Often, you’ll realize you can live without it.

- Examples of Items to Delay:

- New gadgets (e.g., the latest phone or smartwatch).

- Expensive clothes or accessories.

- Luxury home items like decor or kitchen gadgets.

- Redirect Savings: For every purchase you pause, transfer the equivalent amount to your travel fund.

9. Use Coupons and Cashback Apps

- Leverage Discounts: Search for coupons or promo codes before making any online purchase using platforms like Honey, RetailMeNot, or Rakuten.

- Cashback Apps: Earn back a percentage of what you spend through apps like Rakuten, Ibotta, or Fetch Rewards.

- Combine Strategies: Use coupons, buy during sales, and earn cashback to maximize savings.

- Tip: Stack these savings with a rewards credit card (if you pay off the balance monthly) for even more benefits.

10. Reduce Utility Costs

- Energy Savings:

- Turn off lights and unplug devices when not in use.

- Use energy-efficient bulbs and appliances.

- Lower your thermostat by a degree or two in winter or raise it in summer.

- Water Usage:

- Take shorter showers.

- Fix leaks and use water-saving fixtures.

- Internet and Phone Bills: Call your providers to negotiate lower rates or look for cheaper plans.

- Example Savings: If you reduce your electric bill by $20/month and water bill by $10/month, that’s $360/year you can save for your trip.

Lifestyle Changes

11. Find Free Entertainment

- Explore Your Community:

- Check local event calendars for free concerts, festivals, or outdoor movie nights.

- Visit parks, museums (on free admission days), or community centers for activities.

- Replace Expensive Activities:

- Swap paid activities (like going to the movies or a theme park) with affordable or free ones, such as hiking, picnicking, or biking.

- Stay Social Without Spending: Invite friends for a potluck, board game night, or a walking tour of your city instead of meeting at a bar or restaurant.

12. Carpool or Use Public Transit

- Share Rides: Organize carpools with coworkers or friends to save on gas and reduce wear and tear on your vehicle.

- Public Transit:

- Use buses, trains, or subways to lower commuting costs.

- If you’re in a city with frequent rideshare use (e.g., Uber or Lyft), consider public transit instead for a fraction of the cost.

- Example Savings: If you typically spend $200/month on gas and parking but switch to public transit at $100/month, that’s $1,200 saved annually.

13. Limit Alcohol and Coffee Outings

- Cut Alcohol Costs:

- Reduce how often you drink at bars or restaurants, where drinks can cost 2–3 times more than at home.

- Host gatherings with affordable drinks or even mocktail nights.

- Brew Coffee at Home:

- A $5 daily coffee shop visit adds up to $150/month. Invest in a coffee maker and high-quality beans for a similar experience at a fraction of the cost.

- Savings Breakdown: Swapping a $12 weekly bar tab and $5 daily lattes for $3 home-brewed coffee could save you over $2,000 a year.

14. DIY Personal Care

- At-Home Grooming: Learn to trim your own hair, do your nails, or dye your hair at home using tutorials and affordable tools.

- Simple Self-Care: Replace spa treatments with DIY facials, body scrubs, or massages using household items like sugar, coconut oil, or essential oils.

- Save on Fitness: Cancel expensive gym memberships and use free online workout classes, YouTube channels, or outdoor fitness options.

Maximizing Savings

15. Use a Reward Credit Card

- Maximize Rewards:

- Choose a credit card that offers travel rewards, cashback, or points that can be redeemed for flights, hotels, or experiences.

- Prioritize cards with no annual fees unless the benefits outweigh the costs.

- Smart Spending:

- Only use the card for planned purchases and pay off the balance in full each month to avoid interest charges.

- Example Rewards: If you spend $1,000/month on groceries and bills and earn 2% cashback, you’ll save $240/year toward your trip.

16. Participate in Gig Work

- Find Flexible Gigs:

- Offer services like pet sitting (Rover), babysitting (Care.com), or driving (Uber, Lyft).

- Sell handmade goods on platforms like Etsy or provide freelance services on Fiverr or Upwork.

- Micro Tasks:

- Complete surveys, test websites, or do small gigs on sites like Amazon Mechanical Turk or UserTesting.

- Leverage Your Skills:

- If you’re a skilled photographer, offer family portrait sessions. If you’re bilingual, try tutoring or translating.

- Earnings Potential: Even earning an extra $100–$200/month through side gigs can make a significant difference in your travel fund over time.

17. Negotiate Bills

- Call Service Providers:

- Contact your internet, cable, or insurance providers and ask for lower rates or promotional discounts.

- Mention competitors’ offers to strengthen your case.

- Consolidate Services:

- Bundle services like internet and phone to get better rates.

- Use Negotiation Apps:

- Apps like BillShark or Truebill can negotiate on your behalf, taking a small percentage of the savings.

- Savings Example: Negotiating a $20 reduction in your monthly phone bill saves $240/year.

18. Declutter Subscriptions

- Consolidate or Share Accounts:

- Share streaming accounts with family or friends (check the terms of service).

- Opt for annual subscriptions when they offer discounts compared to monthly payments.

- Rotate Subscriptions:

- Instead of keeping multiple subscriptions active, cycle through them. For example, keep Netflix for 2 months, then pause it and switch to Hulu.

- Evaluate Necessity: If you’re using a subscription less than 3 times a month, it might be worth canceling.

Social and Lifestyle Adjustments

19. Host Social Events at Home

- Save on Outings:

- Instead of dining out, invite friends for a potluck, game night, or movie marathon.

- Ask everyone to bring a dish or drink to share the costs.

- Cost Comparison: Hosting a potluck might cost $20 for ingredients, compared to a $50 meal at a restaurant. Multiply this by multiple events to see significant savings.

- Make It Fun: Create themes like taco night or a dessert exchange to make home events just as exciting as going out.

20. Set a No-Spend Challenge

- How It Works:

- Commit to not spending on non-essentials for a set time (e.g., a week or a month).

- Only buy necessities like groceries, gas, or bills during this period.

- Challenge Variations:

- A “no eating out” challenge.

- A “no shopping for clothes” challenge.

- Gamify It: Track the money you didn’t spend and immediately transfer those savings to your travel fund.

- Savings Example: If you usually spend $200/month on dining out and cut it entirely for 3 months, that’s $600 added to your trip savings.

21. Borrow Instead of Buying

- Tap Into Your Network:

- Need a tool, outfit, or book? Ask friends or family before purchasing.

- Use Sharing Libraries:

- Many communities have libraries for tools, cookware, or even party supplies.

- Borrow books, eBooks, and audiobooks from your local library instead of buying.

- Savings Example: Borrowing a dress for an event instead of buying one ($0 vs. $100).

22. Opt for Minimalist Living

- Declutter Regularly: Sell or donate items you no longer need to make space and avoid unnecessary purchases.

- Adopt a “One In, One Out” Rule: For every new item you bring into your home, let go of something you already own. This helps curb impulse buys.

- Focus on Experiences Over Things: Use your desire to travel as motivation to spend less on material possessions.

- Savings Impact: Spending less on new clothes, gadgets, and decor can free up hundreds of dollars annually for your trip.

23. Get Travel Savvy Early

- Start Researching Deals:

- Look for discounts on flights, accommodations, and activities well in advance. Sign up for alerts on platforms like Google Flights, Skyscanner, or Scott’s Cheap Flights.

- Find Free or Low-Cost Activities: Many cities offer free walking tours, festivals, or discounts for tourists.

- Book During Off-Seasons: Traveling during less busy times can save you 20–50% on many costs.

- Use Rewards Points: If you have credit card points, airline miles, or hotel rewards, plan how to maximize their value for your trip.

With these adjustments to your social habits and lifestyle, you can not only save money for your trip but also build long-term habits that lead to greater financial mindfulness. Remember to prioritize what’s important to you and make gradual changes to make them last.

Save on Pinterest for later: